Why You Should Buy Pet Insurance

Fluffy is in the hospital and needs immediate, life-saving surgery that will cost nearly $5000 – can you comfortably pay for the surgery? Does it mean the loss of an upcoming vacation? Defaulting on a couple of mortgage payments? Or maybe it means Fluffy is euthanized because the money is just not there to save her life.

At times of great emotional upset, would it not be better to know you are making health care decisions for your pet based on what is best for them, not on the financial impact of the emergency? It is easy to say before an emergency takes place that this is the dollar amount you are willing to face to save the life of your pet – we can all be pragmatic when Fluffy is playing with her ball of wool in the living room, happy and content. But when faced with an emergency, it is not as easy to be pragmatic. And what happens if the life-saving surgery is within your budget so you go ahead, only to have complications follow requiring more than your ‘set’ dollar amount? Do you then put Fluffy down when you have already invested so much into keeping her alive and a part of your family?

Types of pet Insurance

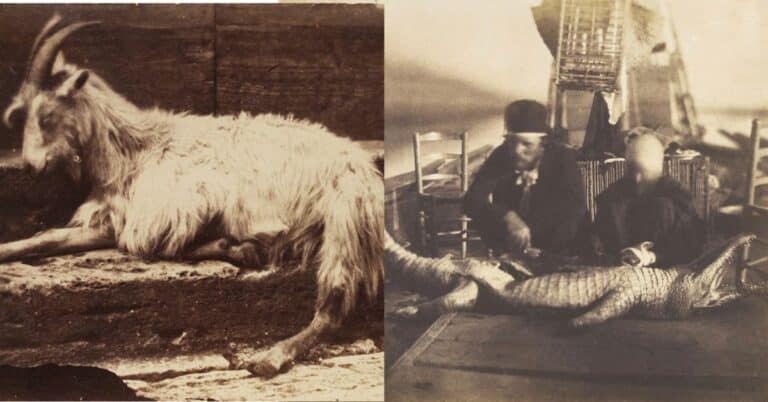

Pet insurance is based on two types of coverage – all-inclusive and emergency. Plans vary in coverage, ranging from complicated plans that cover everything from routine vaccinations and flea medication as well as complicated cancer treatment to plans that only cover emergency treatment. There are also seniors plans, inside-only cat plans, bird plans, and exotic pet insurance that includes amphibians, reptiles, and pocket pets.

What insurance coverage is best for you and your pet depends on many factors. In the case of dogs, ask your veterinarian if your particular breed of dog is prone to any common ailments. For example, King Charles Cavaliers are prone to a multitude of heart troubles, while a Golden Retriever may have problems with hip dysplasia . Knowing this, would it not make sense to make sure there is extensive coverage for cardiac aliments in whatever insurance you purchase?

The Pros of Pet Insurance

If you put some thought into your pet’s coverage and understand what you are paying for, pet insurance can be a life-saving, and wallet-saving, purchase.

- A fixed monthly expense makes budgeting easy.

- Emergency care does not have to be based on your financial situation.

- A wide variety of options are available to cover all foreseeable problems.

The Cons of Pet Insurance

This is where research can save you headaches as well as big bucks in the end.

- Pre-existing conditions are not covered so the earlier a pet is put on insurance, the better.

- Certain breeds are penalized by insurance companies as being at a higher risk for illness.

- Some insurance companies charge more if you live in large urban areas or areas where vets regularly charge more per procedure.

- Paying up front. Rarely do pet insurance companies cover the cost at the time of the procedure but instead reimburse you as they see fit.

Choosing a Pet Insurance Policy

Always do your research on both the company and the various policies before signing on the dotted line. Insurance of any type is a gamble and is only appreciated when you actually need it, while the rest of the time it is yet another expense.

Many companies allow you to pay less per month if you keep the deductible or percentage covered higher. Ask yourself whether you would be able to afford a $500 deductible on a $2000 surgery and if the answer is yes, you will probably find your monthly payments are far less.

Other things to keep in mind while shopping for pet insurance:

- Ask your vet and his staff what company they prefer to work with and whether they have heard any stories from clients for or against a particular company.

- Talk to others that have pet insurance and find out what their experiences have been.

- Find out about the coverage in your area and whether the company covers expenses if you are traveling with your pet.

- Many companies offer multiple pet discounts so if you have three pets you would like covered, find out which will give you the better deal!

Ask anyone who has covered the cost of an expensive treatment for their pet and they will say they wished they had pet insurance at the time. In some cases, for as low as $15 or $20 a month, your pet can be covered for any emergency treatment – a pretty inexpensive safety net when you think of the alternative costs associated with any emergency treatment.

Having discovered a fondness for insects while pursuing her degree in Biology, Randi Jones was quite bugged to know that people usually dismissed these little creatures as “creepy-crawlies”.